Understanding the California Franchise Tax Board (CA FTB) is crucial for individuals and businesses operating within the state. Whether you're filing your personal taxes or managing corporate tax responsibilities, the FTB plays a significant role in ensuring compliance with California's tax laws. This comprehensive guide will break down everything you need to know about CA FTB, from its functions to essential filing requirements.

California's tax system can be complex, especially for those unfamiliar with its rules and regulations. The Franchise Tax Board is the governing body responsible for administering state tax laws, making it vital for taxpayers to understand its role and processes. By gaining a deeper understanding of CA FTB, you can avoid common pitfalls and ensure your tax obligations are met accurately and on time.

This article aims to provide clear, actionable insights into the workings of the California Franchise Tax Board. From deadlines and forms to penalties and appeals, we'll cover everything you need to stay compliant and informed. Let's dive into the details.

Read also:Sers Ohio A Comprehensive Guide To Ohios State Employees Retirement System

Table of Contents

- Introduction to CA FTB

- Functions of CA FTB

- Tax Filing Process

- Common Tax Forms

- Deadlines and Extensions

- Penalties and Interest

- Appeals Process

- Resources and Support

- Tips for Compliance

- Conclusion and Next Steps

Introduction to CA FTB

The California Franchise Tax Board (FTB) is the state agency responsible for administering California's tax laws. Established to ensure fair and equitable tax collection, the FTB oversees a wide range of tax-related activities, including personal income tax, corporate taxes, and franchise taxes.

Key Points:

- The FTB manages tax filings for individuals, businesses, and other entities.

- It enforces tax laws and ensures compliance through audits and investigations.

- The agency provides resources and support for taxpayers to understand their obligations.

Understanding the FTB's role is essential for anyone who earns income or operates a business in California. By familiarizing yourself with its functions, you can navigate the tax system more effectively.

Functions of CA FTB

Primary Responsibilities

The FTB performs several critical functions to maintain the integrity of California's tax system. These include:

- Tax Collection: The FTB collects taxes from individuals, businesses, and other entities.

- Enforcement: It enforces tax laws through audits, investigations, and penalties for non-compliance.

- Education: The agency provides educational resources to help taxpayers understand their responsibilities.

Role in Economic Development

Beyond tax administration, the FTB plays a role in California's economic development. By ensuring fair tax practices, it helps create a stable financial environment for businesses and individuals alike. This stability encourages investment and growth within the state.

Tax Filing Process

Filing taxes with the California Franchise Tax Board involves several steps. Here's a breakdown of the process:

Read also:Ymca Bellevue A Comprehensive Guide To Your Community Hub

Gathering Necessary Documents

- W-2 Forms

- 1099 Forms

- Business financial statements

Having these documents ready ensures a smoother filing process and reduces the risk of errors.

Choosing the Right Filing Method

Taxpayers can choose between electronic filing (e-filing) and paper filing. E-filing is generally faster and more secure, while paper filing may be necessary for certain situations.

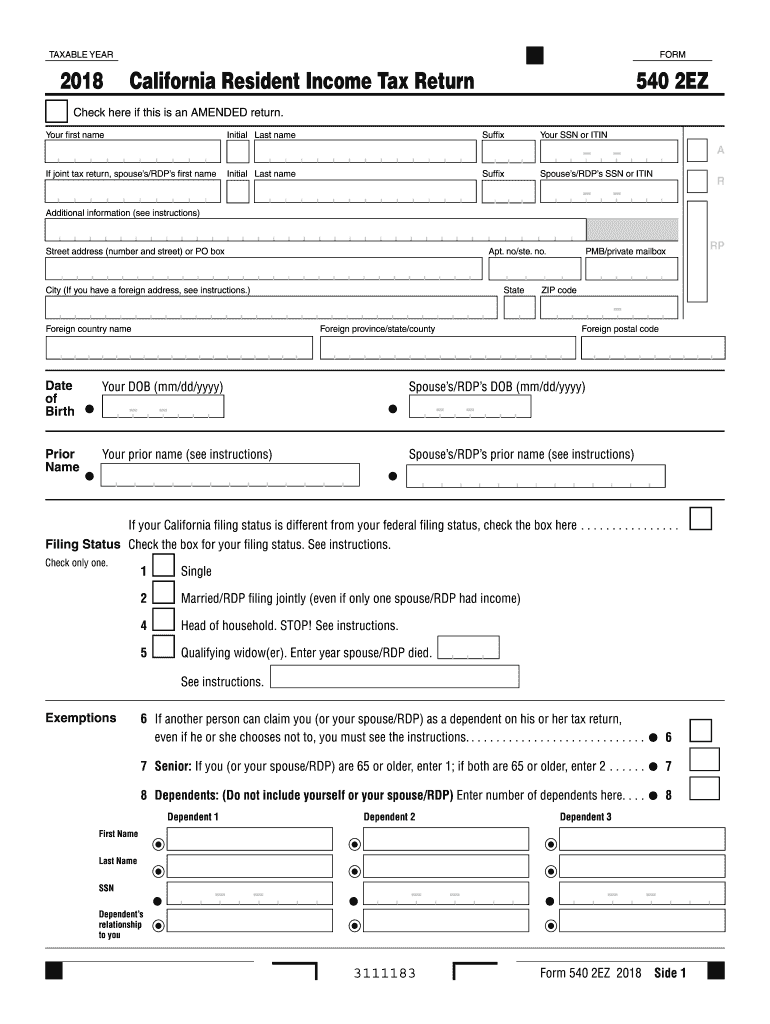

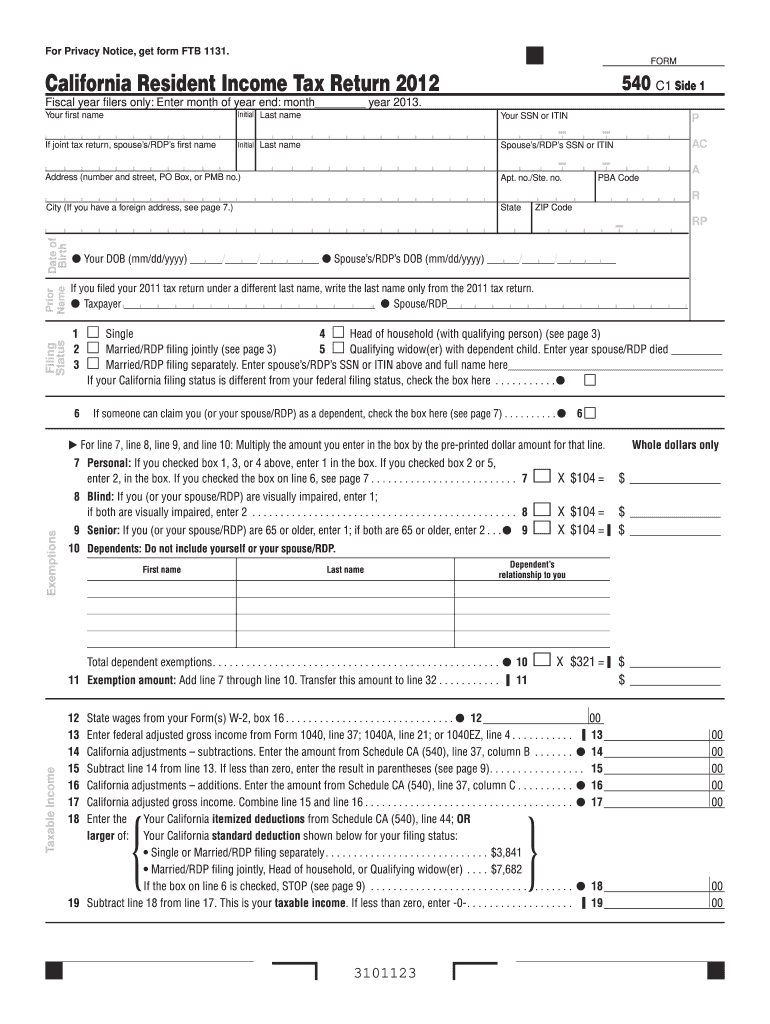

Common Tax Forms

The FTB requires various forms depending on the type of tax being filed. Here are some of the most common forms:

- Form 540: Resident Income Tax Return

- Form 540NR: Nonresident and Part-Year Resident Income Tax Return

- Form 100: Corporation Franchise or Income Tax Return

Each form is designed to address specific tax obligations, so it's important to use the correct one for your situation.

Deadlines and Extensions

Tax Deadlines

California tax deadlines typically align with federal deadlines. For most taxpayers, the deadline is April 15th. However, businesses and certain individuals may have different deadlines based on their tax obligations.

Requesting an Extension

If you're unable to file by the deadline, you can request an extension. This must be done before the original deadline and requires Form 4868 for federal taxes and Form 3519 for California taxes.

Penalties and Interest

Failing to file or pay taxes on time can result in penalties and interest. The FTB assesses these charges to encourage timely compliance. Common penalties include:

- Failure-to-file penalty

- Failure-to-pay penalty

- Underpayment penalty

Interest is also charged on unpaid taxes, compounding monthly until the balance is paid in full.

Appeals Process

If you disagree with an FTB decision, you have the right to appeal. The appeals process involves several steps:

- Submit a written protest to the FTB

- Attend a conference with an FTB representative

- File an appeal with the California Office of Tax Appeals if necessary

Understanding this process can help you effectively challenge any unfair assessments or penalties.

Resources and Support

FTB Website

The FTB website is a valuable resource for taxpayers. It provides forms, instructions, and FAQs to help you navigate the tax system. Additionally, the site offers tools like e-filing and payment options.

Customer Service

The FTB offers customer service through phone, email, and in-person assistance. These services can help you resolve issues or answer questions about your tax obligations.

Tips for Compliance

To ensure compliance with CA FTB regulations, consider the following tips:

- Stay informed about changes in tax laws and regulations.

- Keep accurate records of your income and expenses.

- File and pay taxes on time to avoid penalties and interest.

- Seek professional advice if you're unsure about your tax obligations.

By following these guidelines, you can minimize the risk of non-compliance and ensure a smooth tax filing experience.

Conclusion and Next Steps

In conclusion, the California Franchise Tax Board plays a vital role in administering the state's tax laws. By understanding its functions and processes, you can better navigate the complexities of California's tax system. Remember to stay informed, file on time, and utilize available resources for support.

We encourage you to take the following actions:

- Review the FTB website for additional information and resources.

- Bookmark this article for future reference.

- Share it with others who may benefit from the insights provided.

If you have any questions or comments, please feel free to leave them below. Your feedback is valuable in helping us improve our content and assist more taxpayers.

Data Sources:

- California Franchise Tax Board Official Website

- IRS Guidelines for State Tax Filings

- California Office of Tax Appeals