New York income tax is a critical financial obligation for residents and businesses operating within the state. Understanding how this tax system works can save you from potential penalties and ensure you're maximizing your deductions and credits. Whether you're a first-time filer or a seasoned taxpayer, staying informed is key to managing your finances effectively.

New York State has one of the most complex tax systems in the United States. The state's income tax structure is designed to generate revenue for public services while ensuring fairness across different income brackets. However, navigating the intricacies of New York's tax laws can be overwhelming without proper guidance.

This article will provide a detailed overview of New York income tax, including its rates, filing requirements, deductions, and credits. We'll also explore common misconceptions and offer tips to help you optimize your tax strategy. By the end of this guide, you'll have a clear understanding of how to manage your tax obligations efficiently.

Read also:How Tall Is Dkane Discover The Height And Other Fascinating Facts

Table of Contents

- Introduction to New York Income Tax

- New York Income Tax Rates

- Filing Status Options

- Deductions and Credits

- Who Must File?

- Common Tax Mistakes to Avoid

- Understanding Tax Withholding

- Amending Your Tax Return

- Resources for Taxpayers

- Conclusion

Introduction to New York Income Tax

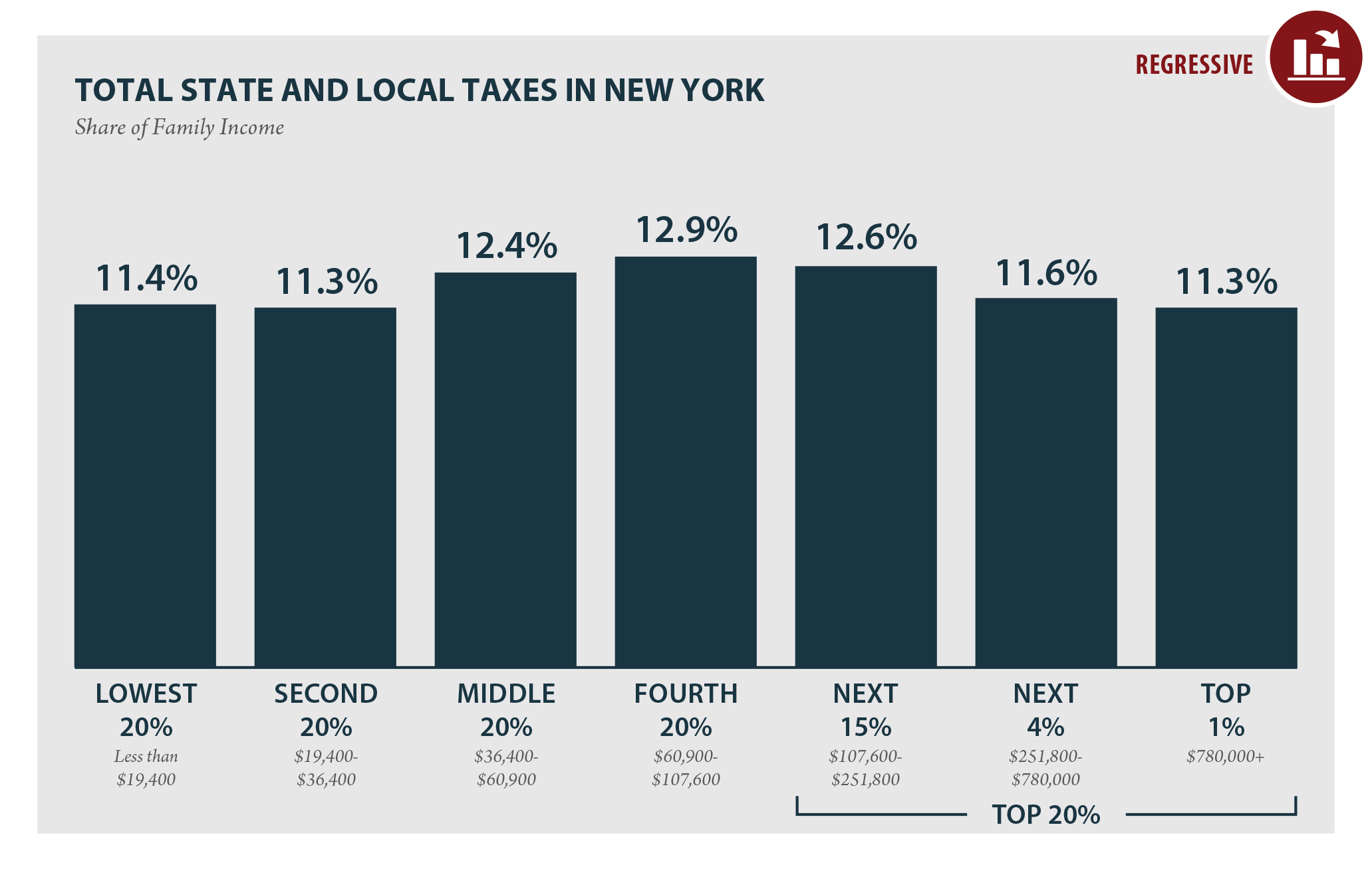

New York State imposes an income tax on individuals, estates, and trusts that generate income within its borders. This tax is a significant source of revenue for the state government, funding essential services such as education, healthcare, transportation, and public safety. The tax system is progressive, meaning that higher-income earners pay a higher percentage of their income in taxes.

Key Features of New York Income Tax

Some of the key features of New York's income tax include:

- Progressive tax brackets based on income levels.

- Various deductions and credits to reduce taxable income.

- Special rules for part-year residents and nonresidents.

- Electronic filing options to simplify the process.

New York Income Tax Rates

The New York State income tax rates vary depending on your filing status and income level. As of 2023, the state has eight tax brackets, ranging from 4% for low-income taxpayers to 8.82% for those earning over $1 million annually.

2023 Tax Brackets for Single Filers

Here are the tax brackets for single filers in New York State:

- 4% on income up to $8,500

- 4.5% on income between $8,501 and $11,700

- 5.25% on income between $11,701 and $23,400

- 5.97% on income between $23,401 and $215,400

- 6.23% on income between $215,401 and $1,077,500

- 8.82% on income over $1,077,500

Filing Status Options

When filing your New York income tax return, you must choose a filing status that best describes your situation. The available options include:

Single

This status applies to individuals who are unmarried and do not qualify for any other filing status. It is the most straightforward option for those living alone and supporting themselves.

Read also:Best Billiard Cue A Comprehensive Guide To Choosing The Perfect Cue Stick

Married Filing Jointly

Couples who are married and choose to file a joint return can combine their incomes and deductions. This option often results in lower tax liability compared to filing separately.

Head of Household

This status is available to unmarried individuals who maintain a home for a qualifying dependent, such as a child or elderly parent. It offers more favorable tax rates than the single status.

Deductions and Credits

New York State offers several deductions and credits to help taxpayers reduce their taxable income and lower their tax liability. Some of the most common ones include:

Standard Deduction

All taxpayers can claim a standard deduction, which varies based on filing status. For example, single filers can deduct $8,000, while married couples filing jointly can deduct $16,000.

Child Tax Credit

Parents with qualifying children under the age of 17 may be eligible for the Child Tax Credit, which provides a credit of up to $2,000 per child.

Education Credits

Taxpayers who paid for higher education expenses may qualify for credits such as the Lifetime Learning Credit or the American Opportunity Credit.

Who Must File?

Not everyone is required to file a New York State income tax return. Whether you need to file depends on your gross income, filing status, and age. For example, single filers under 65 with a gross income of at least $10,000 must file a return.

Exceptions to Filing Requirements

Some individuals may not need to file a return even if their income exceeds the threshold. These exceptions include:

- Nonresidents with no New York source income.

- Part-year residents with minimal income while living in the state.

- Dependents claimed on another taxpayer's return.

Common Tax Mistakes to Avoid

Making errors on your tax return can lead to penalties, interest charges, and delays in receiving your refund. Here are some common mistakes to watch out for:

Incorrect Social Security Number

Ensure that the Social Security numbers listed on your return match those on your W-2 forms and other tax documents.

Missing Deductions and Credits

Failing to claim all eligible deductions and credits can result in paying more taxes than necessary. Double-check your forms to ensure you haven't overlooked anything.

Incorrect Filing Status

Choosing the wrong filing status can affect your tax liability and refund amount. Review your situation carefully to determine the best option for you.

Understanding Tax Withholding

Tax withholding is the process by which employers deduct a portion of your paycheck to cover your estimated tax liability. This system helps ensure that taxpayers pay their taxes throughout the year rather than in a lump sum at tax time.

Adjusting Your Withholding

If you find that too much or too little tax is being withheld from your paycheck, you can adjust your withholding by submitting a new W-4 form to your employer. This can help you avoid surprises when it comes time to file your return.

Amending Your Tax Return

Sometimes, taxpayers discover errors or omissions on their original tax return after it has been filed. In such cases, you can file an amended return using Form IT-255 to correct the information.

Reasons to Amend a Return

Common reasons for amending a return include:

- Reporting additional income.

- Claiming additional deductions or credits.

- Correcting filing status or dependent information.

Resources for Taxpayers

The New York State Department of Taxation and Finance provides numerous resources to help taxpayers understand and comply with their obligations. These include:

Online Filing Tools

Taxpayers can use the department's online filing tools to submit their returns electronically, track the status of their refunds, and make payments.

Publications and Guides

The department publishes various guides and publications that explain tax laws, regulations, and procedures in plain language. These resources are available on their website for free.

Conclusion

New York income tax is a complex but essential aspect of financial management for residents and businesses in the state. By understanding the tax rates, filing requirements, deductions, and credits, you can ensure compliance and optimize your tax strategy. Remember to avoid common mistakes and take advantage of available resources to simplify the process.

We encourage you to share this article with others who may benefit from it and leave a comment below if you have any questions or feedback. For more information on New York income tax and other financial topics, explore our website's other articles and resources.

Source: New York State Department of Taxation and Finance