State franchise tax board plays a crucial role in the financial landscape of businesses across the United States. It ensures that corporations and other entities contribute their fair share to the state's economy through various tax obligations. If you're a business owner, understanding this tax board is essential for maintaining compliance and avoiding costly penalties.

The complexities of state tax laws can be overwhelming, but having a clear understanding of how the state franchise tax board operates can help you navigate the system effectively. This article will delve into the intricacies of the state franchise tax board, providing you with valuable insights and actionable advice.

By the end of this guide, you'll have a solid grasp of what the state franchise tax board is, its responsibilities, how it affects businesses, and the steps you need to take to ensure compliance. Let's get started!

Read also:Is Professor Dumbledore Gay Exploring The Debate Surrounding The Iconic Wizard

Table of Contents

- What is the State Franchise Tax Board?

- A Brief History of the State Franchise Tax Board

- The Role of the State Franchise Tax Board

- Types of Taxes Administered by the State Franchise Tax Board

- Ensuring Compliance with the State Franchise Tax Board

- Penalties for Non-Compliance

- Resources for Businesses

- Tips for Navigating State Franchise Tax Board Requirements

- The Impact of the State Franchise Tax Board on Small Businesses

- The Future of the State Franchise Tax Board

What is the State Franchise Tax Board?

The State Franchise Tax Board (SFTB) is a government agency responsible for administering taxes for businesses operating within a state. In states like California, the SFTB is a critical entity that ensures businesses fulfill their tax obligations. The primary function of the SFTB is to collect franchise and income taxes from corporations, partnerships, and other business entities.

The SFTB also plays a vital role in enforcing tax laws and ensuring that businesses comply with state regulations. By maintaining accurate records and conducting audits, the SFTB helps safeguard the financial integrity of the state's economy.

Key Functions of the State Franchise Tax Board

Here are some of the key functions performed by the State Franchise Tax Board:

- Collecting franchise and income taxes

- Conducting audits to ensure compliance

- Providing resources and guidance to businesses

- Enforcing penalties for non-compliance

A Brief History of the State Franchise Tax Board

The concept of a franchise tax board dates back to the early 20th century when states began implementing systems to regulate and tax businesses. The State Franchise Tax Board was established to address the growing need for a centralized agency to manage tax collections and ensure compliance. Over the years, the SFTB has evolved to adapt to changing economic conditions and technological advancements.

Evolution of the SFTB

The evolution of the State Franchise Tax Board reflects the changing needs of the economy. Initially, the focus was on collecting franchise taxes, but as businesses grew more complex, the SFTB expanded its scope to include income taxes and other related obligations.

The Role of the State Franchise Tax Board

The State Franchise Tax Board serves as a watchdog for state tax laws, ensuring that businesses adhere to regulations and pay their fair share of taxes. Its primary responsibilities include:

Read also:Raj Hells Kitchen The Ultimate Guide To Masterchef Indias Sensation

- Administering franchise and income taxes

- Providing guidance and resources to businesses

- Conducting audits to verify compliance

- Enforcing penalties for non-compliance

Importance of the SFTB

The SFTB is crucial for maintaining the financial health of a state. By ensuring that businesses contribute their fair share, the SFTB helps fund public services and infrastructure projects that benefit all residents.

Types of Taxes Administered by the State Franchise Tax Board

The State Franchise Tax Board is responsible for administering several types of taxes, including:

- Franchise taxes

- Income taxes

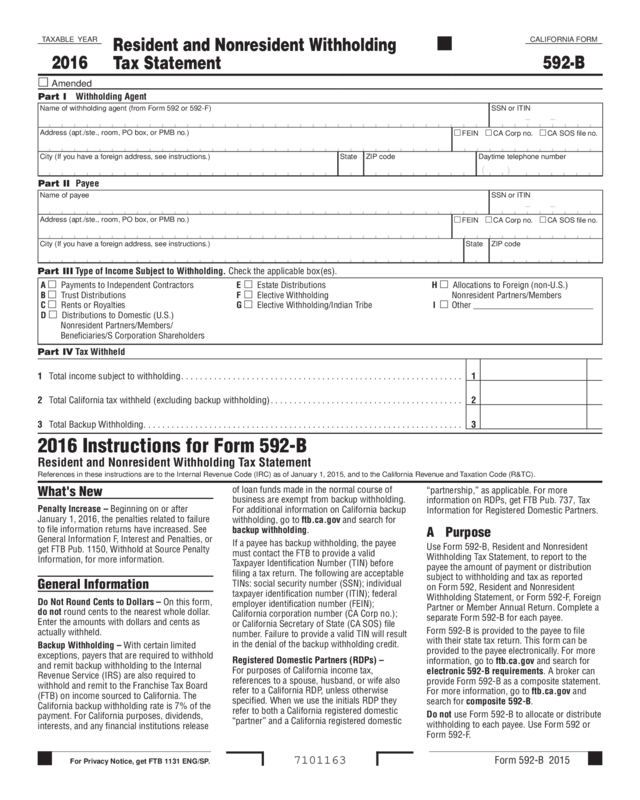

- Withholding taxes

- Employment taxes

Each type of tax has its own set of rules and regulations, and businesses must ensure compliance with all applicable requirements.

Understanding Franchise Taxes

Franchise taxes are levied on businesses for the privilege of doing business within a state. These taxes are typically calculated based on the business's net worth or income, depending on the state's regulations.

Ensuring Compliance with the State Franchise Tax Board

Compliance with the State Franchise Tax Board is essential for avoiding penalties and maintaining a good standing with the state. Businesses should:

- File all required tax forms on time

- Pay taxes accurately and on schedule

- Keep detailed records of all financial transactions

- Respond promptly to any inquiries or notices from the SFTB

Best Practices for Compliance

Implementing best practices for compliance can help businesses avoid costly mistakes. This includes staying informed about changes in tax laws, utilizing accounting software, and consulting with tax professionals when necessary.

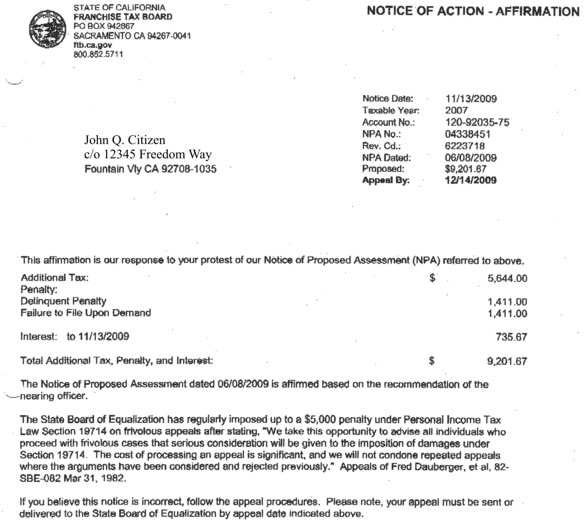

Penalties for Non-Compliance

Failure to comply with the State Franchise Tax Board can result in significant penalties, including fines, interest charges, and even legal action. The severity of the penalties depends on the nature and extent of the non-compliance.

Common Penalties

Some common penalties for non-compliance with the SFTB include:

- Late filing fees

- Interest on unpaid taxes

- Penalties for underpayment

- Legal action for severe non-compliance

Resources for Businesses

The State Franchise Tax Board provides a range of resources to help businesses understand and comply with tax obligations. These resources include:

- Online guides and publications

- Tax calculators and tools

- Customer service support

- Workshops and training sessions

Utilizing SFTB Resources

Businesses should take advantage of the resources provided by the SFTB to stay informed and compliant. This includes regularly checking the SFTB website for updates and attending training sessions to enhance their understanding of tax regulations.

Tips for Navigating State Franchise Tax Board Requirements

Navigating the requirements of the State Franchise Tax Board can be challenging, but with the right approach, businesses can ensure compliance. Here are some tips:

- Stay informed about changes in tax laws

- Use accounting software to manage financial records

- Consult with tax professionals for complex issues

- File all required forms on time

Common Mistakes to Avoid

Avoiding common mistakes is key to maintaining compliance with the SFTB. Some common mistakes include:

- Missing filing deadlines

- Underreporting income

- Incorrectly calculating taxes

- Ignoring SFTB notices

The Impact of the State Franchise Tax Board on Small Businesses

The State Franchise Tax Board has a significant impact on small businesses, which often face unique challenges in complying with tax regulations. Small businesses may struggle with limited resources and expertise, making it essential to seek professional guidance when needed.

Support for Small Businesses

The SFTB offers specific support for small businesses, including simplified filing processes and access to free resources. By taking advantage of these resources, small businesses can better manage their tax obligations.

The Future of the State Franchise Tax Board

As technology continues to evolve, the State Franchise Tax Board is likely to adopt new tools and methods to enhance its operations. This may include increased use of artificial intelligence, blockchain technology, and other innovative solutions to improve efficiency and accuracy.

Trends in State Tax Administration

Emerging trends in state tax administration include greater emphasis on digital transformation, enhanced data analytics, and improved customer service. These trends will shape the future of the SFTB and its role in the business community.

Conclusion

In conclusion, the State Franchise Tax Board is a critical component of the state's tax system, ensuring that businesses contribute their fair share to the economy. By understanding the SFTB's role, responsibilities, and requirements, businesses can maintain compliance and avoid costly penalties.

We encourage you to take action by reviewing your tax obligations, utilizing available resources, and seeking professional guidance when needed. Don't forget to share this article with others who may benefit from the information, and explore our other content for more insights on tax-related topics.