Understanding New York income tax is crucial for anyone who lives, works, or earns income within the state. The tax system in New York is designed to generate revenue for essential public services while ensuring fairness and compliance. Whether you're a resident, a small business owner, or a freelancer, knowing how income tax works can help you plan your finances effectively and avoid potential penalties.

New York income tax is a critical aspect of financial responsibility for individuals and businesses. The state's tax structure is progressive, meaning higher earners pay a higher percentage of their income in taxes. This system aims to distribute the tax burden equitably across income levels while funding vital programs like education, healthcare, and infrastructure.

In this guide, we'll delve into the intricacies of New York income tax, covering everything from tax brackets to deductions, credits, and filing requirements. By the end, you'll have a comprehensive understanding of how the system works and how to navigate it effectively.

Read also:Dkane Height A Comprehensive Guide To Understanding The Iconic Figure

Table of Contents

- Introduction to New York Income Tax

- Understanding New York Income Tax Brackets

- Filing Status Options

- Key Deductions for New York Taxpayers

- Tax Credits Available in New York

- The Filing Process Explained

- Important Filing Deadlines

- Penalties for Late or Non-Filing

- Resources for Taxpayers

- Conclusion and Next Steps

Introduction to New York Income Tax

New York income tax is a cornerstone of the state's revenue generation strategy. The tax is levied on individuals, businesses, and trusts that earn income within the state. It is administered by the New York State Department of Taxation and Finance, which ensures compliance and provides resources for taxpayers.

The tax system in New York is progressive, meaning the tax rate increases as income levels rise. This structure is designed to ensure that those with higher incomes contribute a fair share to support public services. Understanding the basics of New York income tax is essential for anyone who earns income within the state.

Key aspects of New York income tax include:

- Progressive tax rates based on income brackets

- Various filing statuses to accommodate different taxpayer situations

- A range of deductions and credits to reduce taxable income

- Strict deadlines and penalties for non-compliance

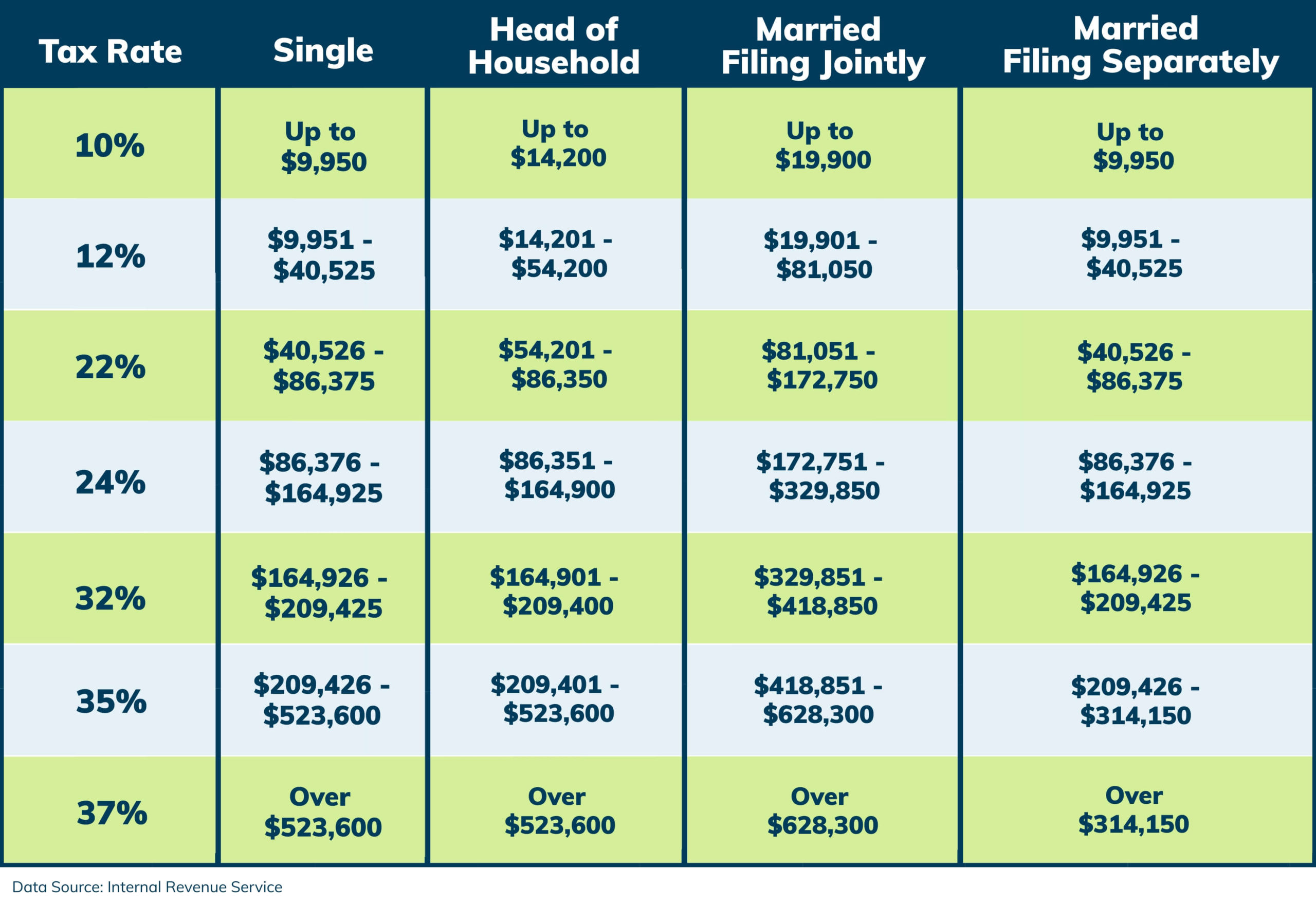

Understanding New York Income Tax Brackets

New York income tax brackets determine the percentage of income that taxpayers owe to the state. These brackets are updated annually to account for inflation and changes in the cost of living. As of the latest updates, the tax rates for New York residents are as follows:

Tax Rates Based on Income Levels

The progressive nature of New York's tax system means that higher earners pay a larger percentage of their income in taxes. Here's a breakdown of the current tax brackets:

- 4% for income up to $8,500

- 4.5% for income between $8,501 and $11,700

- 5.25% for income between $11,701 and $23,400

- 5.97% for income between $23,401 and $215,400

- 6.09% for income between $215,401 and $1,077,550

- 8.82% for income above $1,077,551

These rates apply to individuals filing as single taxpayers. Married couples filing jointly and heads of households have different thresholds and rates, which we'll explore in the next section.

Read also:Pst To Your Ultimate Guide To Understanding And Managing Pst Files

Filing Status Options

In New York, taxpayers can choose from several filing statuses depending on their personal and financial circumstances. These statuses affect the tax brackets and credits available to each taxpayer. The main filing statuses include:

Single Filing Status

This status applies to individuals who are unmarried and do not qualify for any other filing status. Single filers typically have lower income thresholds for tax brackets compared to other statuses.

Married Filing Jointly

Couples who are married and file a joint return can take advantage of higher income thresholds and potentially larger deductions and credits. This status is often beneficial for couples with combined incomes.

Married Filing Separately

Some couples choose to file separately for various reasons, such as maintaining financial independence or avoiding shared liability. However, this status may limit access to certain deductions and credits.

Head of Household

This status is available to unmarried individuals who pay more than half the cost of maintaining a home for themselves and a qualifying dependent. Head of household filers enjoy more favorable tax brackets compared to single filers.

Key Deductions for New York Taxpayers

New York offers several deductions to help taxpayers reduce their taxable income. These deductions can significantly lower the amount of tax owed, making it essential for taxpayers to understand and utilize them effectively.

Standard Deduction

The standard deduction is a fixed amount that taxpayers can subtract from their income if they choose not to itemize deductions. For New York residents, the standard deduction varies based on filing status:

- $8,000 for single filers

- $16,000 for married couples filing jointly

- $12,000 for heads of household

Itemized Deductions

Taxpayers who prefer to itemize deductions can claim specific expenses, such as mortgage interest, charitable contributions, and medical expenses. Itemizing may result in greater tax savings for those with significant deductible expenses.

Tax Credits Available in New York

In addition to deductions, New York offers various tax credits to help taxpayers reduce their tax liability. These credits are subtracted directly from the tax owed, providing a dollar-for-dollar reduction in the amount payable.

Child Tax Credit

This credit is available to taxpayers with qualifying children under the age of 17. The amount of the credit depends on the taxpayer's income and the number of eligible children.

Earned Income Tax Credit (EITC)

The EITC is designed to benefit low- and moderate-income workers. Eligible taxpayers can claim this credit to reduce their tax liability or receive a refund if the credit exceeds the amount owed.

Property Tax Credit

New York residents who pay property taxes on their primary residence may qualify for this credit. The amount depends on factors such as income, age, and whether the taxpayer is a homeowner or renter.

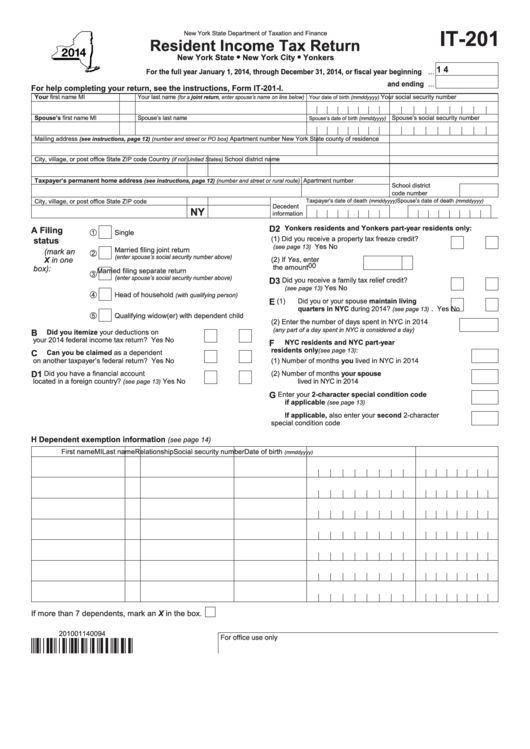

The Filing Process Explained

Filing New York income tax involves several steps, from gathering necessary documents to submitting the completed return. Here's a step-by-step guide to the process:

Gather Required Documents

Before starting the filing process, ensure you have all necessary documents, including:

- W-2 forms from employers

- 1099 forms for freelance or investment income

- Receipts for deductible expenses

- Previous year's tax return for reference

Choose a Filing Method

Taxpayers can file their New York income tax return electronically or by mail. Electronic filing is faster and more secure, with the added benefit of receiving a confirmation of receipt. Paper filing is still an option for those who prefer it.

Important Filing Deadlines

Knowing the deadlines for filing New York income tax is crucial to avoid penalties and interest. The standard deadline for filing is April 15th, unless it falls on a weekend or holiday, in which case the deadline is extended to the next business day.

Extensions

Taxpayers who need more time to file can request an extension. However, this extension only applies to the filing deadline, not the payment deadline. Any taxes owed must still be paid by the original due date to avoid penalties.

Penalties for Late or Non-Filing

Failing to file or pay New York income tax on time can result in significant penalties and interest. The state imposes a late filing penalty of 5% of the unpaid tax for each month the return is late, up to a maximum of 25%. Additionally, a late payment penalty of 0.5% per month applies to unpaid taxes.

Interest Charges

Interest is charged on unpaid taxes at a rate determined annually by the New York State Department of Taxation and Finance. It is compounded daily until the balance is paid in full.

Resources for Taxpayers

New York provides numerous resources to assist taxpayers with understanding and filing their income tax returns. These resources include:

New York State Department of Taxation and Finance Website

The official website offers detailed information on tax laws, forms, and filing instructions. Taxpayers can also access online tools for calculating tax liability and tracking the status of their returns.

Tax Assistance Centers

Residents can visit local tax assistance centers for in-person help with their tax returns. These centers are staffed by trained professionals who can answer questions and provide guidance.

Conclusion and Next Steps

New York income tax is a vital component of the state's financial system, ensuring that essential services are funded while promoting fairness and compliance. By understanding the tax brackets, deductions, credits, and filing process, taxpayers can navigate the system effectively and minimize their tax liability.

To take the next steps, consider reviewing your income and expenses, gathering necessary documents, and consulting with a tax professional if needed. Don't forget to file your return by the deadline and take advantage of available resources to ensure accuracy and compliance.

We invite you to share this guide with others who may find it helpful and encourage you to explore our other articles for more information on personal finance and taxation. Your feedback and questions are always welcome!