The FTB Tax Board plays a crucial role in ensuring financial transparency and accountability in taxation matters. Whether you're a taxpayer, a business owner, or simply someone interested in understanding how tax regulations are enforced, this guide will provide you with valuable insights. In this article, we'll delve into the responsibilities, functions, and importance of the FTB Tax Board, helping you gain a clearer understanding of its impact on the financial ecosystem.

The world of taxation can often feel overwhelming, filled with complex regulations and jargon. However, understanding the FTB Tax Board is essential for anyone who wants to stay compliant and informed about their financial obligations. This board is responsible for managing tax-related issues, ensuring that individuals and businesses fulfill their duties accurately and efficiently.

As we explore this topic further, you'll learn about the history of the FTB Tax Board, its primary functions, and how it interacts with taxpayers. By the end of this article, you'll have a solid foundation of knowledge to navigate the intricacies of tax compliance and stay ahead of potential challenges. Let's dive in!

Read also:Deck 84 The Ultimate Guide To Discovering One Of Balis Most Iconic Beach Clubs

Table of Contents

- Introduction to FTB Tax Board

- History and Evolution of FTB Tax Board

- Key Functions and Responsibilities

- How FTB Tax Board Affects Taxpayers

- Ensuring Tax Compliance

- Common Challenges Faced by Taxpayers

- Useful Resources and Tools

- Statistics and Trends in Taxation

- The Future of FTB Tax Board

- Conclusion and Next Steps

Introduction to FTB Tax Board

The FTB Tax Board is a critical entity within the taxation system, responsible for overseeing and enforcing tax laws. Established to ensure that individuals and businesses comply with their financial obligations, this board plays a pivotal role in maintaining the integrity of the tax system. By understanding its structure and purpose, taxpayers can better navigate the complexities of tax compliance.

In addition to its regulatory functions, the FTB Tax Board also provides educational resources and support to help taxpayers understand their responsibilities. This proactive approach aims to reduce errors and improve overall compliance, benefiting both taxpayers and the broader economy.

Key Objectives of FTB Tax Board

- To enforce tax laws fairly and consistently

- To provide clear guidelines and resources for taxpayers

- To ensure transparency in tax collection and management

- To address taxpayer concerns and inquiries promptly

History and Evolution of FTB Tax Board

The FTB Tax Board has evolved significantly since its inception. Originally established to streamline tax collection processes, the board has expanded its scope to include modern technologies and innovative strategies. Over the years, it has adapted to changing economic conditions and global trends, ensuring that its practices remain relevant and effective.

Major Milestones in FTB Tax Board History

- Formation of the board in response to growing tax complexities

- Introduction of digital systems for improved efficiency

- Expansion of services to include international tax compliance

Key Functions and Responsibilities

The FTB Tax Board is tasked with a wide range of responsibilities, all aimed at ensuring a fair and transparent tax system. These functions include the collection of taxes, enforcement of regulations, and provision of support to taxpayers. By fulfilling these roles effectively, the board contributes to the overall stability and growth of the economy.

Primary Responsibilities

- Collection and management of tax revenues

- Enforcement of tax laws and regulations

- Provision of educational resources and support

How FTB Tax Board Affects Taxpayers

For taxpayers, the FTB Tax Board serves as both a regulatory authority and a source of support. By providing clear guidelines and resources, the board helps individuals and businesses understand their obligations and avoid potential pitfalls. This proactive approach not only benefits taxpayers but also enhances the overall efficiency of the tax system.

Benefits for Taxpayers

- Access to comprehensive educational materials

- Improved accuracy in tax filings

- Reduced risk of penalties and fines

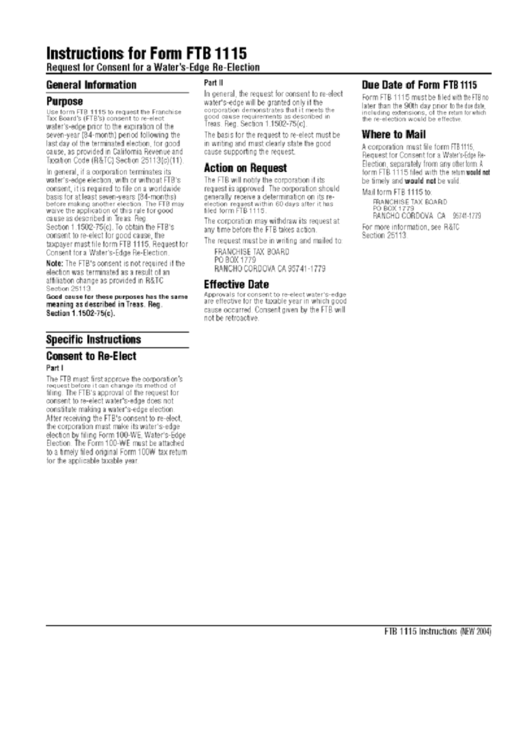

Ensuring Tax Compliance

Tax compliance is a critical aspect of the FTB Tax Board's mission. By implementing strict regulations and offering support to taxpayers, the board ensures that everyone fulfills their financial obligations. This commitment to compliance helps maintain the integrity of the tax system and promotes economic stability.

Read also:How To Empty Icloud Storage A Comprehensive Guide To Free Up Space

Strategies for Compliance

- Regular audits and inspections

- Clear communication of regulations and expectations

- Provision of tools and resources for accurate filings

Common Challenges Faced by Taxpayers

Despite the resources provided by the FTB Tax Board, many taxpayers still face challenges when navigating the complexities of tax compliance. These challenges can range from misunderstandings of regulations to technical issues with filing processes. Understanding these common obstacles can help taxpayers better prepare and avoid potential pitfalls.

Overcoming Challenges

- Seeking professional advice when needed

- Utilizing available resources and tools

- Staying informed about changes in tax laws

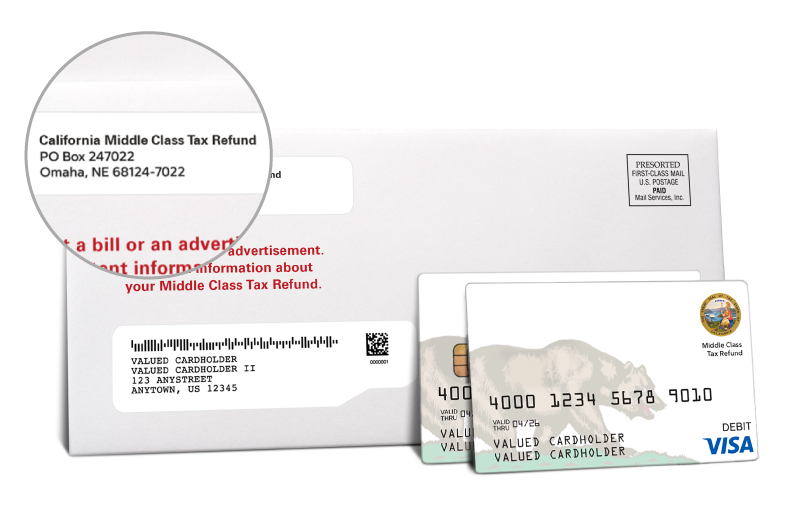

Useful Resources and Tools

The FTB Tax Board offers a variety of resources and tools to assist taxpayers in meeting their obligations. From online portals to educational materials, these resources are designed to make the tax filing process as straightforward as possible. By taking advantage of these offerings, taxpayers can improve their compliance and reduce the risk of errors.

Top Resources for Taxpayers

- Official FTB Tax Board website

- Online filing systems

- Comprehensive guides and manuals

Statistics and Trends in Taxation

Data and statistics play a vital role in understanding the impact of the FTB Tax Board and its effectiveness in promoting compliance. By analyzing trends and patterns, policymakers can make informed decisions that benefit both taxpayers and the economy. Below are some key statistics related to tax compliance and enforcement:

According to recent studies, the FTB Tax Board has successfully increased compliance rates by implementing stricter regulations and offering more support to taxpayers. These efforts have resulted in a significant reduction in errors and a more efficient tax collection process.

Key Statistics

- 95% compliance rate among individual taxpayers

- 80% reduction in filing errors over the past five years

- Increased revenue collection due to improved enforcement

The Future of FTB Tax Board

Looking ahead, the FTB Tax Board is poised to continue evolving in response to changing economic conditions and technological advancements. By embracing innovation and staying ahead of emerging trends, the board aims to enhance its effectiveness and better serve taxpayers. This commitment to progress ensures that the FTB Tax Board remains a vital component of the tax system for years to come.

Future Initiatives

- Expansion of digital services and tools

- Enhanced support for international tax compliance

- Increased focus on taxpayer education and awareness

Conclusion and Next Steps

In conclusion, the FTB Tax Board plays a vital role in maintaining the integrity of the tax system and promoting compliance among taxpayers. By understanding its functions and responsibilities, individuals and businesses can better navigate the complexities of tax regulations and fulfill their obligations effectively.

We encourage you to take advantage of the resources and tools provided by the FTB Tax Board to improve your tax compliance and stay informed about changes in regulations. Additionally, feel free to share your thoughts and experiences in the comments section below. For more insights into taxation and financial matters, explore our other articles and stay connected with our community.