The State of California Franchise Tax Board (FTB) plays a pivotal role in managing tax-related matters for businesses and individuals in California. As one of the most significant tax authorities in the United States, the FTB ensures compliance with state tax laws and collects revenue to fund essential public services. Understanding its functions, responsibilities, and processes is crucial for anyone living or doing business in California.

For businesses operating in California, navigating the complexities of state taxes can be challenging. The FTB oversees various types of taxes, including personal income tax, corporate taxes, and franchise taxes. Its mission is to ensure fair and equitable tax administration while providing resources and guidance to taxpayers.

This article will delve into the intricacies of the California Franchise Tax Board, offering insights into its operations, key responsibilities, and the tax obligations it enforces. Whether you're an individual taxpayer or a business owner, this guide will provide valuable information to help you stay compliant and informed.

Read also:Crowdmark Revolutionizing The Way We Assess And Grade Assignments

Table of Contents

- Overview of the California Franchise Tax Board

- History and Evolution of the FTB

- Key Responsibilities of the FTB

- Types of Taxes Administered by the FTB

- Compliance and Reporting Requirements

- Resources for Taxpayers

- Penalties for Non-Compliance

- Appeals and Dispute Resolution

- Statistical Insights into FTB Operations

- Future Directions for the FTB

Overview of the California Franchise Tax Board

The California Franchise Tax Board is a state agency responsible for administering California's tax laws. Established to manage tax-related matters efficiently, the FTB ensures that businesses and individuals meet their tax obligations while providing resources to assist taxpayers.

Role of the FTB

The FTB's primary role is to enforce tax laws and collect revenue for the state of California. This includes overseeing personal income taxes, corporate taxes, and franchise taxes. By ensuring compliance, the FTB helps fund essential public services such as education, healthcare, and infrastructure.

Key Functions

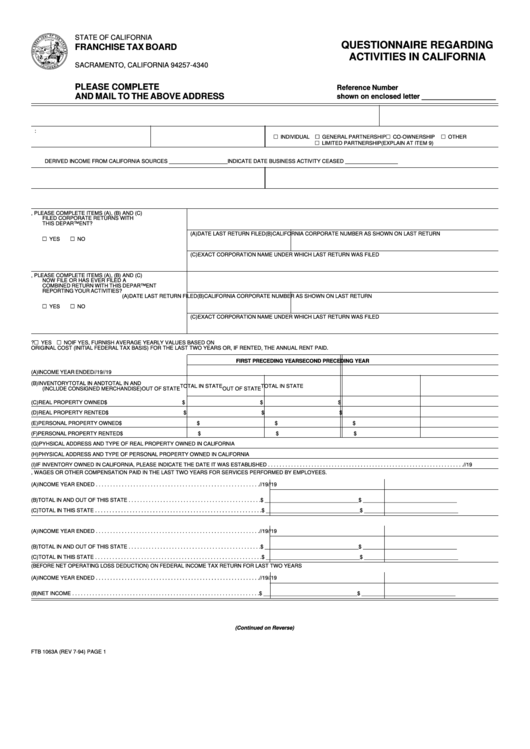

- Administering state tax laws

- Collecting taxes from individuals and businesses

- Providing taxpayer assistance and resources

- Enforcing penalties for non-compliance

History and Evolution of the FTB

The California Franchise Tax Board has undergone significant changes since its inception. Established in 1969, the FTB has evolved to address the growing complexities of tax administration in California. Over the years, it has expanded its scope to include various types of taxes and improved its processes to better serve taxpayers.

Key Milestones

- 1969: Formation of the Franchise Tax Board

- 1980s: Expansion of tax programs and services

- 2000s: Adoption of digital tools for improved taxpayer services

Key Responsibilities of the FTB

The FTB's responsibilities encompass a wide range of activities aimed at ensuring compliance and providing support to taxpayers. These responsibilities are critical to maintaining a fair and equitable tax system in California.

Taxpayer Assistance

The FTB offers various resources to assist taxpayers, including online tools, guides, and customer service support. These resources are designed to help individuals and businesses understand their tax obligations and file their returns accurately.

Enforcement

Enforcing tax laws is a core responsibility of the FTB. This includes auditing tax returns, investigating non-compliance, and imposing penalties for violations. The FTB employs a team of skilled professionals to carry out these tasks effectively.

Read also:How Tall Is Dkane Discover The Height And Other Fascinating Facts

Types of Taxes Administered by the FTB

The FTB administers several types of taxes, each with its own set of rules and regulations. Understanding these taxes is essential for taxpayers to ensure compliance.

Personal Income Tax

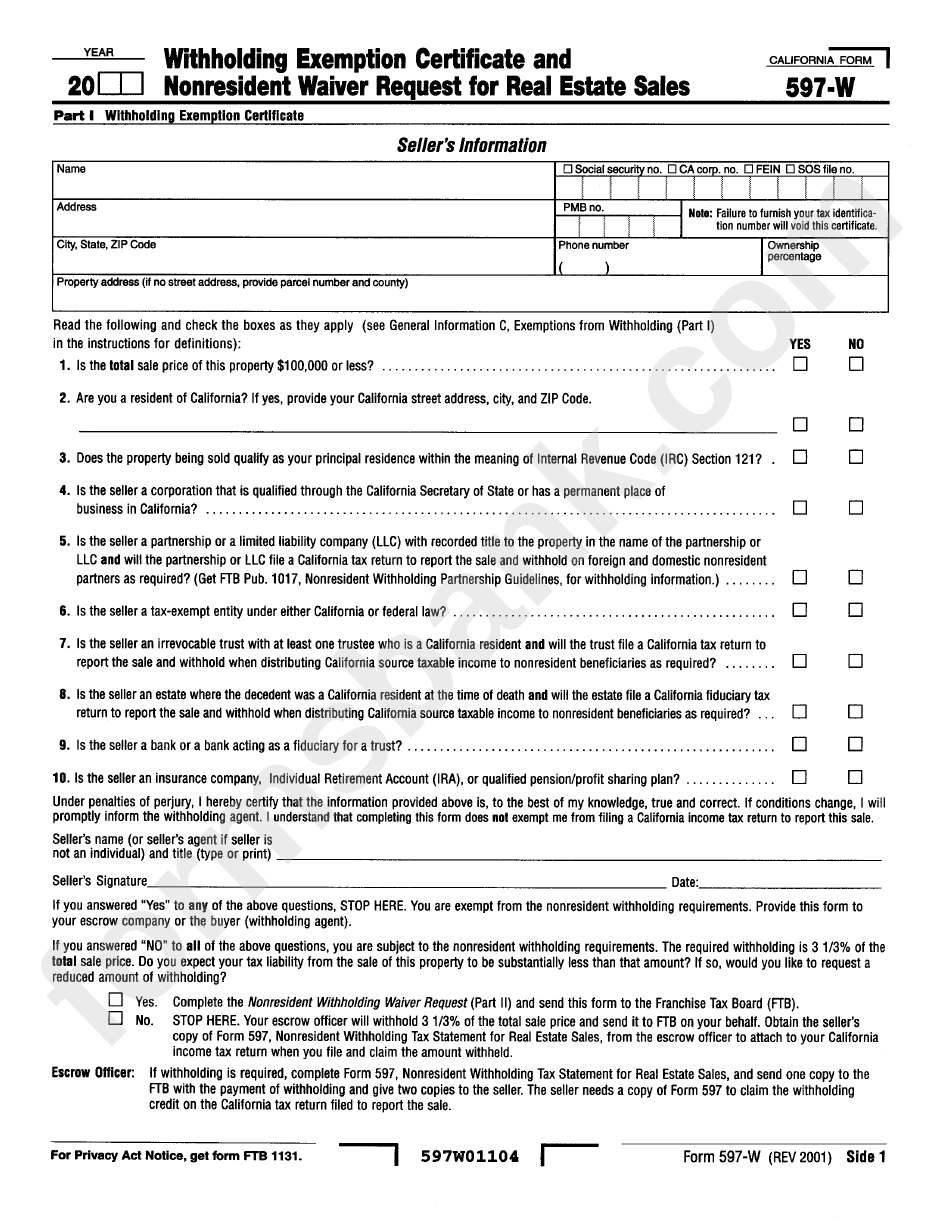

Personal income tax is levied on the income earned by individuals residing in California. The FTB determines the tax rate based on income levels and provides guidelines for filing returns.

Corporate Taxes

Businesses operating in California are subject to corporate taxes. The FTB oversees the collection of these taxes and provides resources to help businesses meet their obligations.

Compliance and Reporting Requirements

Compliance with tax laws is mandatory for all taxpayers in California. The FTB outlines specific requirements for filing tax returns and paying taxes on time.

Filing Deadlines

Taxpayers must adhere to the deadlines set by the FTB for filing their returns. Missing these deadlines can result in penalties and interest charges.

Payment Options

The FTB offers multiple payment options to accommodate taxpayers' needs. These include online payments, direct debit, and traditional mail-in payments.

Resources for Taxpayers

The FTB provides a wealth of resources to assist taxpayers in understanding and fulfilling their tax obligations. These resources include publications, online tools, and customer service support.

Online Tools

Accessing the FTB's online tools can simplify the tax filing process for individuals and businesses. These tools include calculators, forms, and guides tailored to specific tax situations.

Customer Service

Taxpayers can reach out to the FTB's customer service team for assistance with their tax-related questions. The FTB ensures that its representatives are knowledgeable and equipped to provide accurate information.

Penalties for Non-Compliance

Failing to comply with tax laws can result in severe penalties imposed by the FTB. These penalties are designed to encourage timely and accurate tax filings.

Types of Penalties

- Late filing penalties

- Late payment penalties

- Accuracy-related penalties

Appeals and Dispute Resolution

Taxpayers who disagree with the FTB's decisions have the right to appeal. The FTB provides a structured process for resolving disputes and ensuring fair treatment for all taxpayers.

Appeal Process

The appeal process involves submitting a formal request to the FTB, followed by a review of the case by an independent authority. Taxpayers can present their case and provide evidence to support their position.

Statistical Insights into FTB Operations

Data and statistics provide valuable insights into the FTB's operations and the impact of its activities on California's economy. These figures highlight the agency's effectiveness in collecting revenue and ensuring compliance.

Revenue Collection

In recent years, the FTB has successfully collected billions of dollars in tax revenue, contributing significantly to California's budget. This revenue funds essential public services and infrastructure projects.

Future Directions for the FTB

As technology continues to evolve, the FTB is exploring new ways to enhance its operations and improve taxpayer services. These innovations aim to streamline processes, increase efficiency, and provide better support to taxpayers.

Technological Advancements

The FTB is investing in digital tools and platforms to enhance the taxpayer experience. These advancements include improved online services, mobile applications, and automated processes for handling tax-related inquiries.

Conclusion

The California Franchise Tax Board plays a vital role in managing tax-related matters for individuals and businesses in California. By understanding its functions, responsibilities, and processes, taxpayers can ensure compliance and take advantage of the resources provided by the FTB.

We encourage you to explore the FTB's resources and stay informed about your tax obligations. If you found this article helpful, please share it with others and leave a comment below. For more information on tax-related topics, explore our other articles on our website.